Low Income Loan Options

The Australian Government has put in place some measures meant to alleviate the misery of its people, who are affected by the global economic slowdown. If you have good credit and a steady job, banks will be happy to give you a loan. For those that are not in this …

Tips for Financing Your First Car

Whether you have just finished with your studies or have had enough of driving that old vehicle, you’ve made the decision to finance your first car. Before you sign the paperwork and put down the money, what do you need to know about this process?

Property investment 101 – What you need to know

Anyone who is financially minded dreams of reaching that point in life where they have absolute financial security. There are many options available to the keen investor like stocks or bonds, although historically choosing to invest in property has been the most popular choice for Australian punters. Investing in property …

Using a credit card to save money when travelling

For the most part, traveller’s cheques are a thing of the past. While you can still buy them, there are much easier – and cheaper – alternatives available. One such alternative is the mighty credit card.

The History of Australian Money

Do you know that in the early days without money, people could use rum for transactions? Find out more facts about the history of Australian money on the video infographic below:

Peter Dean’s Holiday Debt Advice

Holidays are often the best time of the year. It’s a rare chance for us to escape the daily routine and relax, often by the pool or the sea. Over the years though, holidays have become more and more commercialised, which in turn means that every year people spend more …

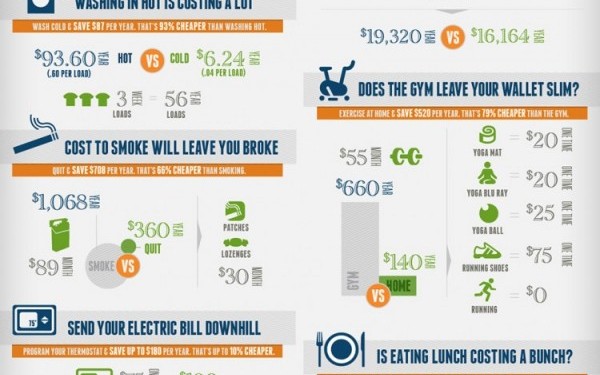

Quicken Loans – 13 Ways to Save

Each year one of the top New Year’s resolutions is to get out of debt. This infographic will show you 13 different money-saving tips that will help you save a combined total of $11,244.00 over the course of one year!

Tipping Customs in the USA

Travelling or living in another country can be a wonderful and exciting experience. However there is one situation that lots of people find confusing and stressful and that is ‘tipping’ (also known as paying a gratuity). Tipping is the practice of showing appreciation for the service you received by gifting …

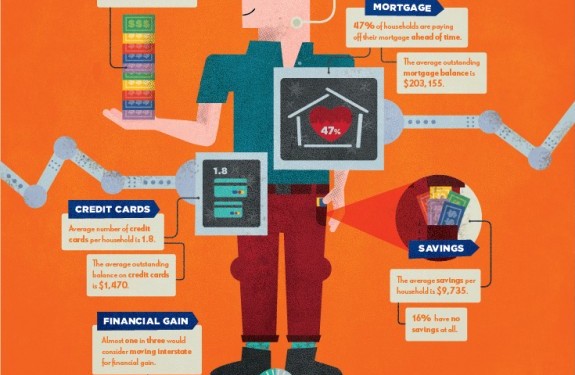

ING Infographic – Australia’s Average Households Financial Wellbeing

Have you ever wondered if you’re taking good enough care of your finances? ING Direct has conducted a survey to discover the financial wellbeing of Australia’s average household. Find out how you measure up in terms of income, financial gain, credit cards, savings, mortgages and investments. If, as a household …

Getting a Debt Do Over

Debt has a tricky way of sneaking up on people as its development in the form of easy credit is planned out and delivered in such an inviting manner. Regardless of income or background, there are easy funding opportunities everywhere and for just about anyone. Payday loans, general personal loans, …