Investing in gold coins the smart way

Gold coins are a great form of investment for private investors. Unlike gold bars, physical gold coins can be bought by the ounce, and it also has a bigger market. People who invest in gold coins are also investing in the precious metal for wealth purposes.

The value of each coin depends largely on its weight. Some coins contain an ounce of gold, half an ounce, a quarter of an ounce, or even 1/10th of an ounce. If you want to save money, stay away from the “rare” gold coins, as gold is hardly valued for its rarity in this day and age. Unless you plan on selling the coins to a rare coin collector, profit is scarce in the rare gold coin industry. What matters is the gold content embedded on each coin.

Biggest gold coin markets

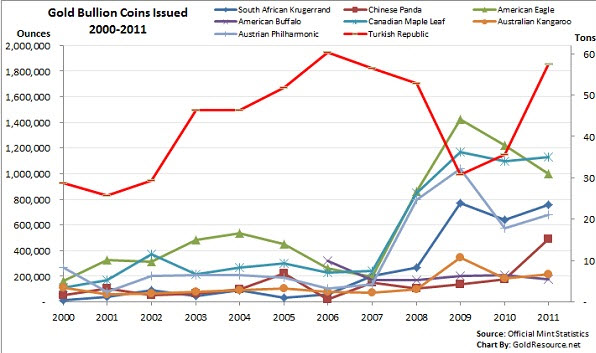

What’s the sense of buying gold coins if you can’t sell them in the future, right? People who wish to invest in gold coins should check out the gold coin market during the last decade. According to this data, the three most sought-after coins from the last 10 years were the Turkish Republic Gold Coin, South African Krugerrand Gold Coin, and the Canadian Maple Leaf Gold Coin.

Turkish Republic Gold Coin

Turkey is the biggest buyer and seller of gold coins. The demand for gold coins in the country is high for two reasons. Firstly, the act of giving gold coins to people who have achieved a milestone in their life has been a long-time tradition in the country. Secondly, the country has long embraced the use of gold as hedge to inflation. Check out the graph above and see how impressive the demand for this gold coin is.

There are two types of gold coins in Turkey: the Meskuk and the Ziynet. The Meskuk is the standard gold coin in Turkey but the Ziynet is more popular since it is primarily used by the people as decorative gifts. Perhaps it would be wiser to invest in Ziynet since the market for it is bigger.

South African Krugerrand Gold Coin

South African Krugerrands are the most popular gold coin in circulation, consisting of around 1/5 of all the coins produced since 1970. They are all 22k and are recognised internationally so investors may trade them wherever they are in the world. Kruggerands have different sizes: 1 full ounce, ½ ounce, ¼ ounce, and the 1/10 ounce. If you plan on buying Kurgerrands, make sure to diversify and buy coins with different weights since the market for each size differs from time to time.

Canadian Maple Leaf Gold Coin

It was the Canadians who first took notice of the popularity of South Africa’s gold coins in the 70s. However, instead of importing the Kruggerands to the country, Canada has produced its own gold coin. The Maple Lead Gold Coin is the first ever 24k coin made for the modern era, having a purity of 99.9%. To date, it is the most popular 24k gold coin with more than 35 million in circulation. The demand for the Canadian Maple Lead Coin has continuously increased since 2008 and it may rival the Turkish Republic in the next couple of years.

Gold coins have brought great wealth to intelligent investors, but they’ve also made a lot of not-so-smart investors lose money last year. The precious yellow commodity is a tough market to break, especially given the volatility of the metal in question. Before putting your money in the precious yellow metal, make sure you learn about the different types of gold investments and get a good grasp of which type will best suit you.

Investors who wish to learn more about gold coin investment may get more information on BullionVault’s site. They may also learn more about the different forms of gold investment on the site, and pick one that will suit them the best.

Image courtesy of foto76 / FreeDigitalPhotos.net

No Comment