Finder.com.au press release: FIXED RATE MORTGAGES INCREASE BY 6.2% WITH LOW CASH RATE

Fixed rate home loan approvals are up 6.2% since January of this year as Australians take advantage of low interest rates. With the cash rate held at 2.75% p.a. today, more Australians are likely to fix their home loan with fixed rates below 5% p.a. to take advantage of the lowest lending rate since 1990.

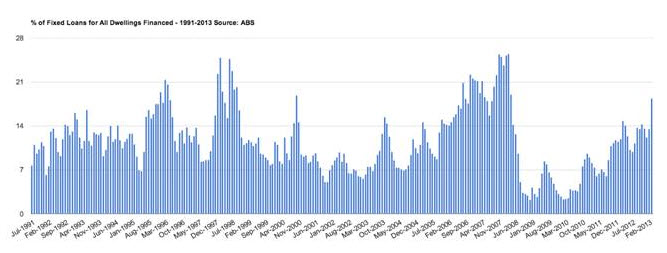

% Fixed Rate Loan of total dwellings financed 1991-2013 Source: ABS

Month Fixed Rate Loan % of total dwellings financed

January 12.2%

February 13.5%

March 18.4%

An Australian with a $400,000 home loan on 4.99% p.a. would pay $2,144.84 per month which equates to $25,738.08 per year. If the interest rate were to rise by 1% they would pay $2395.63 per month which equates to $28,747.56 per year.

By fixing the loan to 4.99% p.a. the homeowner would safeguard against interest rises and can potentially save $3,009.48 over the first year.

Jeremy Cabral, Publisher of leading home loan comparison site Finder.com.au says, “Now could be the time for Australians to take advantage of the low interest rate and maximise the savings they can make on their home loan. Seek advice, do your research and act accordingly to get the best deal on your home loan now.”

Mr. Cabral says there are advantages and disadvantages associated with a fixed rate home loan and Australians should take note of these before signing on the dotted line.

Advantages:

1. Repayments can’t rise during the fixed rate term

This is a safeguard against interest rises as your rate won’t move based on the official cash rate.

1. Helps borrowers budget for the future

If you have fixed while the interest rate is low, this gives you the chance to plan your finances because you know how much you will be paying each month. Lower and steady monthly payments free up extra cash that can help borrowers save or invest surplus funds elsewhere.

Disadvantages:

1. Interest rates won’t drop in line with the official cash rate

If the official cash rate were to drop, then you will remain with the same rate you fixed.

1. Extra repayments are either limited or not allowed

Some banks place limitations on the number of additional payments you’re able to make during the fixed term.

Penalties apply for paying off more than the approved extra repayment limits.

1. Exit fees

If you exit the loan you will face up to $195 – $300 in fees as well as a possible early repayment cost which can add up to tens of thousands of dollars.

1. Lower flexibility with home loan features

You may not have access to a redraw facility during the fixed term. Also, you won’t be able to link a 100% offset account to the loan to help reduce the interest cost.

“There clearly are benefits to a fixed rate home loan but consumers need to weigh up the pros and cons and decipher whether this is the best option for them to suit their financial situation. It’s important not to rush into the decision based on today’s announcement,” concludes Mr. Cabral.

Finder.com.au is a free service for comparing home loans and finance products available to Australian mortgage borrowers.

No Comment