Live a Greener Lifestyle with an Energy Efficient Home

As the number of new homes being built continues to rise across the country, Aussie households are consuming more energy and demanding more of the power grid. Green living is a hot topic at the moment, and now more than ever Australians are becoming increasingly aware of using energy more …

HomeLoanFinder press release – 35% OF AUSSIES STRESSED ABOUT MORTGAGE REPAYMENTS

35% of Australians have experienced stress relating to their mortgage in the last 12 months, according to a survey released today by

Dealing with Emotional Stress During a Move

Moving to a new place carries a certain degree of stress with it. For some it could be far more unpleasant than for others, but there are always ways you can limit that. You can truly enjoy the act of moving if you view things in a more positive light, …

How to Get a Short Term Loan without Paying Back an Arm and a Leg

Why a Short Term Loan? When people need money for a holiday, to refurbish their homes or even to pay for their children’s school fees, they often consider getting a loan.

Sell Gold vs Investing in Gold – Put it in Context

Gold is possibly one of the most sought after commodities on the market and whether it using it jewellery, investing in it, or selling it, there is no doubt that businesses and individuals the world over understand its value. Or do they?

Scrapheap Challenge – Is it time to let go of your car?

When do you know it’s time to call the wreckers to collect your wheels? Is it the kilometres you’ve racked up, the chips in the paint or the realisation that none of your other friends are driving cars that still sport a bumper sticker saying “Jobs, not GST”?

Top Destinations for the Budget-Conscious Traveler

A lot of people typically think that travelling is solely a costly privilege to be had where you have to shell out a few thousand dollars in order to fully enjoy your trip. Despite this fact, there are actually a good number of ways one can discover different parts of …

Understanding Lender’s Mortgage Insurance and how you can avoid it

So you’ve decided to buy a house. Congratulations! No doubt you have been building up a deposit for that dream home for some time. As a standard rule of thumb, saving a 20% deposit on the house’s total value will allow a borrower to avoid paying Lender’s Mortgage Insurance (LMI).

Never Pay a Big Bill Again

Imagine never having to pay a large bill again; car insurance, health insurance, council rates, unexpected bills and more. These are all things that can be avoided by following one simple budgeting technique. It’s all a matter of being organised.

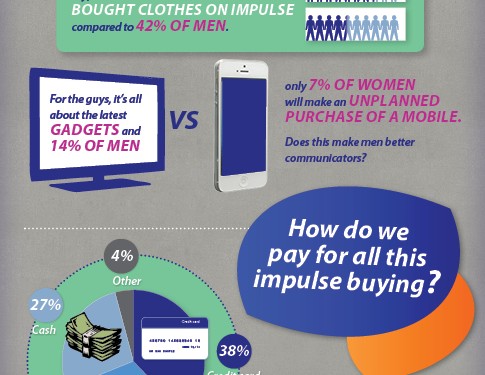

Impulse Buy Infographic – Rabo Direct

Everybody loves to score a great deal, but more and more of us seem to be wasting unnecessary funds by impulsively buying items we don’t really need. Impulse buying appears to be rising to alarming levels in the modern day consumer, with over 81% of us admitting that we have …