Comparing car insurance in Australia – 5 things to consider

Choosing car insurance can be a stressful process for many people, and with so much variety it is sometimes hard to know which option is the right one for you. If unsure, it is helpful to be able to compare car insurance to see where you are likely to get …

How to get the best home loans on the market… for you

For many people, owning a home is the ultimate life goal but it can take years of hard work to build up the wealth it takes successfully purchase a place. Because of this, most people will usually need to receive some assistance from the banks to ease the financial strain, …

Loans without a Credit Check

If you have applied for multiple loans and been declined and are in need of immediate cash but don’t want to further impact your credit rating with more credit checks, there are options. Having an impaired or bad credit rating already puts one at a disadvantage when trying to apply …

Credit Card Help

Getting into credit card debt is easy. With low minimal repayments and high credit limits, incremental purchases on clothes, holidays, restaurants, etc. can easily put a person into the negative. If you have found yourself in a position where you have maxed out your credit card or credit cards and …

Australian Pet Insurance

As with many things in life such as owning a home, car, or boat, owning a pet represents a financial investment. Fortunately, pet insurance exists in order to cover many of the potential costs associated with owning a pet. As technology in pet medicine has increased over the past decades, …

What is the Difference between Good and Bad Debt?

If you have ever done research or read books on personal finance, chances are you have heard of the terms good debt and bad debt come up. One of the big questions you may have is, “What is the difference? Debt is debt right?” While there are various definitions and …

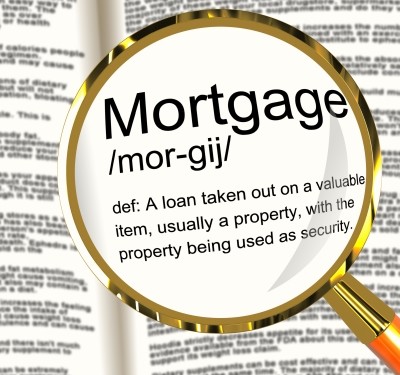

Decoding the Language of Home Loans

Purchasing your first home can be a daunting experience, and it can be made even more intimidating by the seemingly endless amounts of acronyms and home loan jargon. While it may all seem very intimidating at first, in this article we’ll aim to clue you in on some of the …

Help with bills

If you are finding it difficult to meet all you financial commitments, there are multiple things you can do to help ease these pressures. Unexpected financial issues can happen, whether from sickness, job loss, relationship breakup or some other form of unfortunate circumstance. Depending on the severity of these issues …

Do I Need Insurance?

If you are genuinely thinking about insurance and are asking yourself why you need it? You probably already know the answer. While insurance is an unwanted expense, it is a necessary cost to protect yourself and family against the unexpected financial losses from personal injury, death and damage to property …

Practical Money Saving Tips

There are literally thousands of ways to save money. Advice and tips may range from practical easy to implement ideas to extreme penny pinching practices. Hands down, the first and best place to start for any type of money saving strategy is with creating a true budget that reflects all …