Trust Fund – Is It a Good Idea?

Trust funds may seem as the province of the wealthy in the modern world, but establishing one comes with a lot of benefits, regardless of your financial status. Essentially, they are financial tools that are set up for persons, organizations and charities, and they allow them to set provisions on the money or assets inside the trust.

This means that if you would like to manage your money and assets, or even ensure that they are distributed as you would wish upon your demise, then a trust fund is all you need to effortlessly accomplish it.

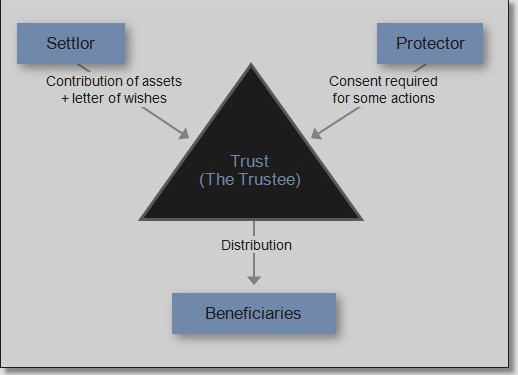

Actually, to put it in much simpler words, a trust is a legal document established by an individual or organization known as the grantor, and its role is to administer money and other assets to a specific person or organization called a beneficiary. The trust is typically controlled and maintained by a team of trustees who manage funds according to your instructions. However, in some instances, the grantor or a trusted family member, a friend or a professional may be assigned the role of a trustee.

Ideally, a trust fund can contain stocks, cash, bonds, and any other important financial instrument and when set up there will be a trustee and a beneficiary. The beneficiary receives payment from the fund in periodic installments or as a lump sum, depending on the terms of the trust.

Types of trust funds

There are two prominent types of trust funds, such as the living and testamentary trust funds. The only difference between the two is mainly based on the footings of how and when they are set up. For instance, a living trust fund is established during the lifetime of the grantor, and thus can be changed or dissolved by the grantor (revocable).

On the other hand, testamentary trust funds are set forth in a will, and hence they are always irrevocable. This means that the provisions of the trust cannot be changed or dissolved since the grantor is dead. In most cases, funds established to reduce or avoid the tax burden usually fall under this category. However, it is important to mention that there are other various types of trust funds that fall under living or testamentary trusts, and each is structured slightly differently.

Why are trust funds a good idea?

1. Help avoid probate

This is often cited as a good reason why you need to start a trust fund because avoiding a probate can save you a substantial amount of time and money in form of legal fees. A probate won’t be necessary if your property and money are distributed according to your will, therefore your descendants will bypass the tedious process of determining the validity of your will. Perhaps it is important to point out that a probate is a long and boring process that can take up to 2 years to conclude.

2. Eliminate family feuds

Establishing a trust fund is certainly the best way to get rid of needless family feud, especially if it involves the inheritance of an expensive property. Basically, a trust is a document that allows you as a grantor to detail the exact items and monetary amounts to be left to each beneficiary, given that it’s highly customizable. In fact, it is true to say that trust funds offer more control in complex family situations than a will, and hence it helps eliminate family conflicts.

3. Reduce estate taxes

Estate tax can be defined as a form of taxation effected upon transfer of property after your death. Fortunately, setting up a trust fund can help you reduce or even avoid estate taxes because property and assets placed into a trust are not taxable. However, there are limits on how much you can put into a trust without incurring taxes.

4. Offer greater privacy

Unlike a will, trusts offer greater privacy because they do not go through probates. This means that there are usually no public records and the information concerning the beneficiaries is always kept private. However, in some rare cases, there will be a public record if the trust is funded from a pour over provision in a will.

You don’t have to be wealthy to have a trust because it can be a valuable financial tool for you and your heirs. Unfortunately, the expenses associated with opening a trust might not be worth it, unless you have a substantial amount of properties and money. The good thing is that now there is a way to create and download the necessary documentation for a trust from the Internet, after you consider the benefits of having one and the expenses involved.

Image from http://en.wikipedia.org/wiki/File:Chart_of_a_trust.jpg

No Comment