How to Fix a Bad Credit Rating

Bad credit ratings have a crippling effect on borrowing options, limiting loan amounts with unfavourable rates and terms. Regardless of the severity of your bad credit rating, there are steps you can take to fix a bad credit rating and maintain a positive one.

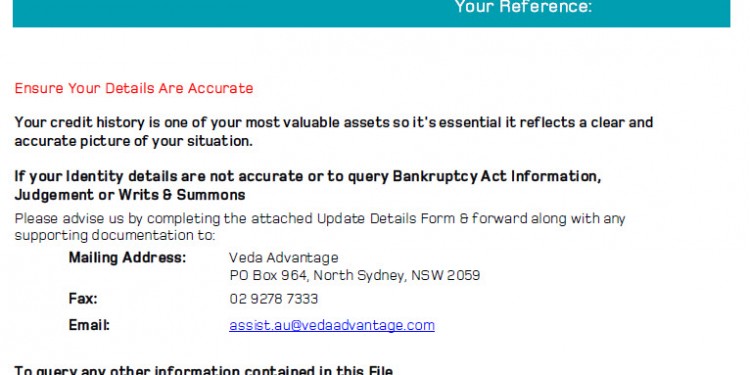

The first step in removing bad credit is to understand what your credit rating comprises of. In Australia, there are a few companies that provide official credit rating reports, the two largest companies are Veda Advantage and Dun & Bradstreet . Below are a few tips on how to fix a bad credit rating.

Review your Credit Report

Upon obtaining your credit report, you want to review it carefully to identify any errors. Some of the things you should look for include:

- Mistaken Identity – Another person with a similar or same name may have been added to your report.

- Identity Theft – Someone may have stolen your details and are fraudulently using your identity.

- Creditor Mistakes – Creditors are not perfect and may have not closed off an account properly or marked an invoice/bill as paid.

- Unknown Bills – There are different types of fees you may have incurred but are unaware of or forgotten about – i.e. Traffic violations, parking tickets, etc

The above examples outline some of the quickest ways in updating and fixing your credit rating. After establishing any possible errors in your report you need to address actual blemishes that you are responsible for.

Organise your debts

Depending on your situation, a debt consolidation loan might be the best option, simply payoff all your creditors and defaults with one loan. Make sure you cancel all old accounts to remove the temptation of charging up new debt. There are multiple advantages to a consolidation loan as it can reduce overall interest rates, save thousands of dollars in interest, possibly reduce repayment terms and provide one manageable monthly payment. This in itself is easier to manage and service and helps reduce some of the things that cause poor credit such as missed and late payments.

If a traditional consolidation loan isn’t an option for you, there are alternative solutions.

- Create a budget and stick to it, paying all bills on time; in addition

- Sell stuff on ebay

or have a garage sale to get some additional cash to pay down debt and/or bills.

- Ask a family member for a loan

- Explore other consolidation solutions like: A debt agreement, informal arrangements, mortgage refinance, personal insolvency agreements and as a last resort, bankruptcy. * Some of the options within this last point can have a impact on your credit score for a number of years, but debt will be cleared.

By organising and controlling your debt, you are able to address existing issues such as defaults and be in a better situation to avoid late payments and defaults in the future. Over time your credit rating will repair itself returning your credit rating to a positive state.

To maintain a positive credit rating, establish strong financial habits and regularly check your credit report to identify any mistakes as pointed out under the Review your Credit Report section.

5 Comments

Thanks for placing up this article. I’m unquestionably frustrated with struggling to research out pertinent and rational commentary on this matter. everyone now goes in the direction of the amazingly much extremes to possibly generate home their viewpoint that either: everyone else within earth is wrong, or two that everyone but them does not genuinely recognize the situation. pretty numerous many thanks for the concise, pertinent insight….

excellent issues altogether, you just gained a new reader. What could you recommend in regards to your post that you simply made a few days ago? Any certain?

[…] be able to qualify for main stream personal loans you will have to fix your credit rating which will take some time, but is worth the […]

This is exactly the thing I’ve been rummaging for! Wonderful and thank you!

I just want to say I am new to blogs and honestly savored your page. Almost certainly I’m going to bookmark your website . You actually have terrific writings. Appreciate it for sharing with us your web-site.